“.. I mean, it’s pretty evident by the conversations we’ve had in the last 2 days, nobody, including myself, on this board has an in-depth understanding of our finances or how our investments work.” –President Shawn Fain, February 20, 2025 IEB meeting, page 162, line 17.

The cynical view of the above comment is that shame on Shawn and the rest IEB for being two years into their terms without asking critical questions about how the UAW manages its finances and investments. And for passing a resolution to cash in hundreds of millions of dollars in equities without apparently first understanding the implications. The generous view is that kudos to the IEB for finally having an open discussion about this, as historically it seems like while a small group of Officers and within the Secretary-Treasurer’s office probably understood, the majority of our political leaders on the IEB probably haven’t understood. And certainly, very very few members understand.

The UAW’s finances are complicated, for sure. And now we have two forces that are likely going to drive a discussion about the UAW’s finances at the next Constitutional Convention. So in these pages, I’ll try to give members a decent idea of the way things are set up now, and what the issues are, so that members can ask good questions of their leaders and make informed decisions.

First of these forces driving a change is one of the reforms the Monitor is demanding: a budget. I have long been critical of the UAW, an organization with over $1 billion in assets and $300 million per year in disbursements, for not having a budget. It just seems on the surface like leaders aren’t looking ahead enough, and that there are probably resources that aren’t being maximized to help achieve organizational goals. On the other hand, the system as it is, is pretty stable. Most of what the UAW does are things they have to do, either legally or constitutionally. And with the cash accounting system being used, with the hundreds of millions in investment appreciation as a rainy day fund that isn’t on the books to bail them out when things get bad, there just hasn’t been too much to worry about from year to year, usually.

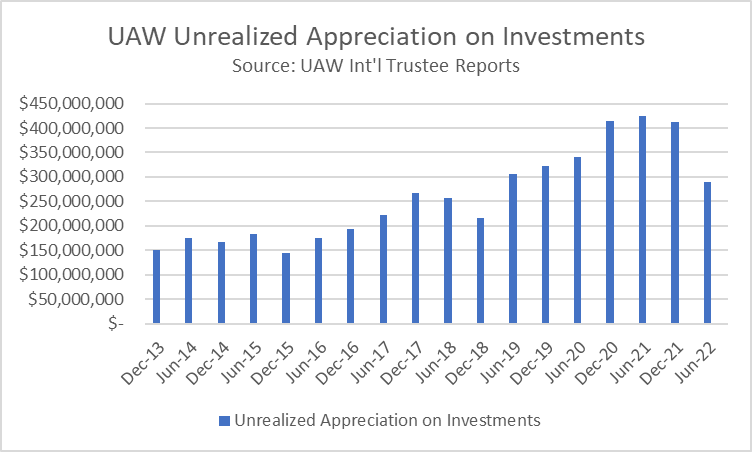

The other issue driving change is the “unrealized appreciation” on investments. From 2013-2022 (see chart below), the UAW has had from just under $150 million to just over $400 million in appreciation on investments that isn’t reflected on the financial reports to members, strike fund reports, DOL LM2’s, IRS 990’s, etc., until the investments are cashed in. It is however, noted on the International Trustee Reports, in the external auditor report section, Note 4 (your Local’s Financial Secretary is supposed to provide you with access to these documents in LUIS upon request). With the cash accounting system this is legal and in accordance with professional accounting standards that the unrealized appreciation is not reported. But I have argued for years using various means that members should at least know this money is out there and available to the IEB. It could sway discussions/decisions about increases in strike pay or whether to take on certain organizing drives. Without knowing about this money, it makes the assets available seem lower, and likely drives excessively conservative financial decisions.

There are people on the IEB who want to tap into this investment appreciation for more organizing (truth be told, I am in this camp too, within sound judgment), and that this appreciation be realized on a predictable basis and included in the budget, so I believe a good discussion and understanding about investments is important. Within the bounds of sound judgment.

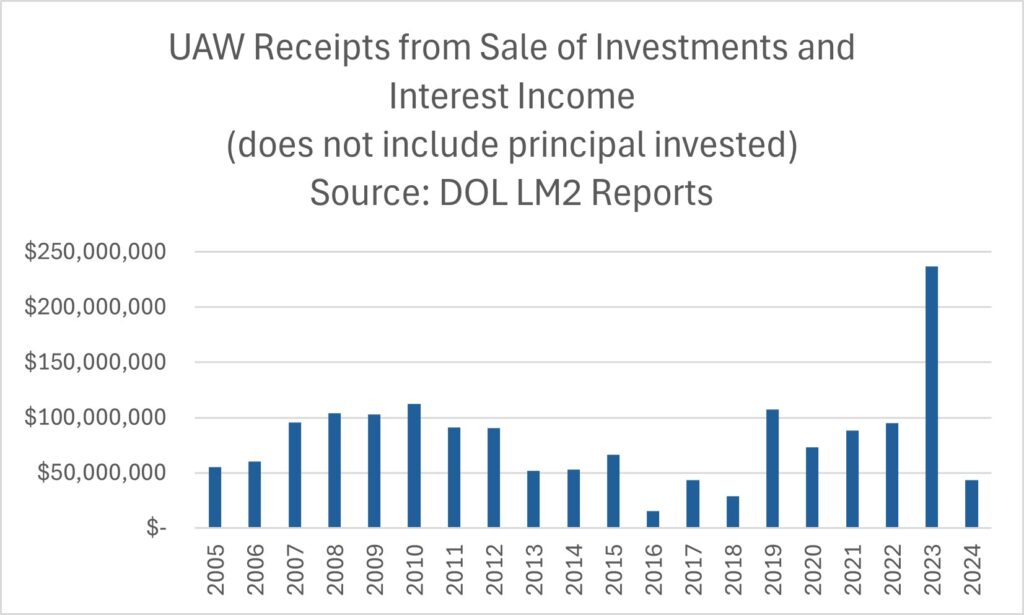

“What we’re going to show later is that realizing gains off our investments, off the Strike Fund, is a material and substantial part of our revenues and has been for years.” — Jason Wade, Top Administrative Assistant to the President, at February 20, 2025 IEB meeting.

“So again, looking at the major issue and trying to diagnose them, the failure to disclose this market value for the Strike and Defense Fund provides a distorted picture of the union’s revenue’s and expenses.” — Max Fazeli, UAW Research Department, at February 20, 2025 IEB meeting.

“This is just another example of an out of touch International Executive Board that places its own agenda above that of the membership,” Shawn Fain, the Members United candidate for president, told The Intercept in response to information in the internal audit. “While the Curry Administration claims to be transparent, I find it shameful that the membership has been misled as to the actual value of the strike fund, and that our leadership has severely underreported that value.” —Just How Much is the UAW Strike Fund Worth? The Intercept, November 16, 2022 [Note: More than 2 years into President Fain’s term as President this is still not being reported to members].

“And this has huge implications because $341M [unrealized appreciation] is about the size of the UAW’s annual budget, and is more than a third of the total assets. Had this been known at the convention it might well have steered the debate about the $400/$500/week strike pay. … I believe it is extremely unethical for our Officers not to mention the $341M or so [unrealized appreciation] when telling members verbally and in financial reports the financial state of our Union and strike fund. This underreporting grossly distorts the financial condition of our Union.” –UAW Retired Member Frank Goeddeke, online UAW Ethics Complaint, August 1, 2022.

According to UAW Top Administrative Assistant Jason Wade, investment income flowing to the General Fund over the last 15 years averaged about $63 million per year (Feb 20, 2025 IEB meeting, p48)[note–from the LM2 reports, I find investment income averages about $80 million per year the last 15 years and most of it could have gone to whatever use the IEB believes to be in the best interests of the Union]. This is notable considering that per capita taxes (member dues) are in the $200 million range per year. The IEB decided in August 2023 to sell off all of the equities in the Strike Trust ($174M cost basis, $335M market value), anticipating a large and prolonged Big 3 strike. The appreciation from these investments resulted in somewhere around a $200 million one-time infusion which will cover (for a while) the deficit spending the UAW has been engaged in lately (In the June 6, 2023 IEB meeting, the UAW’s Chief Accountant Kim Geromin called this a “$30 million problem a year”). Of that $200 million infusion, the UAW spent about $75 million to pay the balance off on the UAW staff retiree health care VEBA. There appears to be confusion about how to reinvest the money that wasn’t used in the strike, and now the Monitor is investigating this (no money is missing, the issue being investigated is why it wasn’t reinvested according to an earlier IEB resolution).

There is also the possibility the Strike and defense Fund will hit or be near the $850 million trigger before or around the time of the next convention, which would lower dues from 2.5 hours per month to 2.0 hours per month (private sector). And consider there are ideas floating around to raise dues even higher than the 2.5 hours.

So yeah, between the budgeting process, the examination into the Strike and Defense Fund and unrealized appreciation, and possibility of dues being raised or lowered, I believe this will be the impetus for a union-wide discussion of how the UAW should run its finances and investments in the future. Constitutional reforms will likely be proposed at the next Constitutional Convention and significant changes may occur. That is why it is important that members have a good understanding of the UAW’s finances, the sooner the better.